The Mortgage Ultimate Planner Excel Template is an all-in-one solution for anyone looking to buy or refinance a property. You can map multiple properties, test between FRM and ARM rates, plan your repayments, test savings scenarios and so much more!

The Mortgage Ultimate Planner Excel Template is an all-in-one solution for anyone looking to buy or refinance a property. You can map multiple properties, test between FRM and ARM rates, plan your repayments, test savings scenarios and so much more!

Planning to buy or refinance a home can feel overwhelming. Our Mortgage Excel Template transforms complex mortgage data into clear insights, helping you make confident, informed decisions on your property journey.

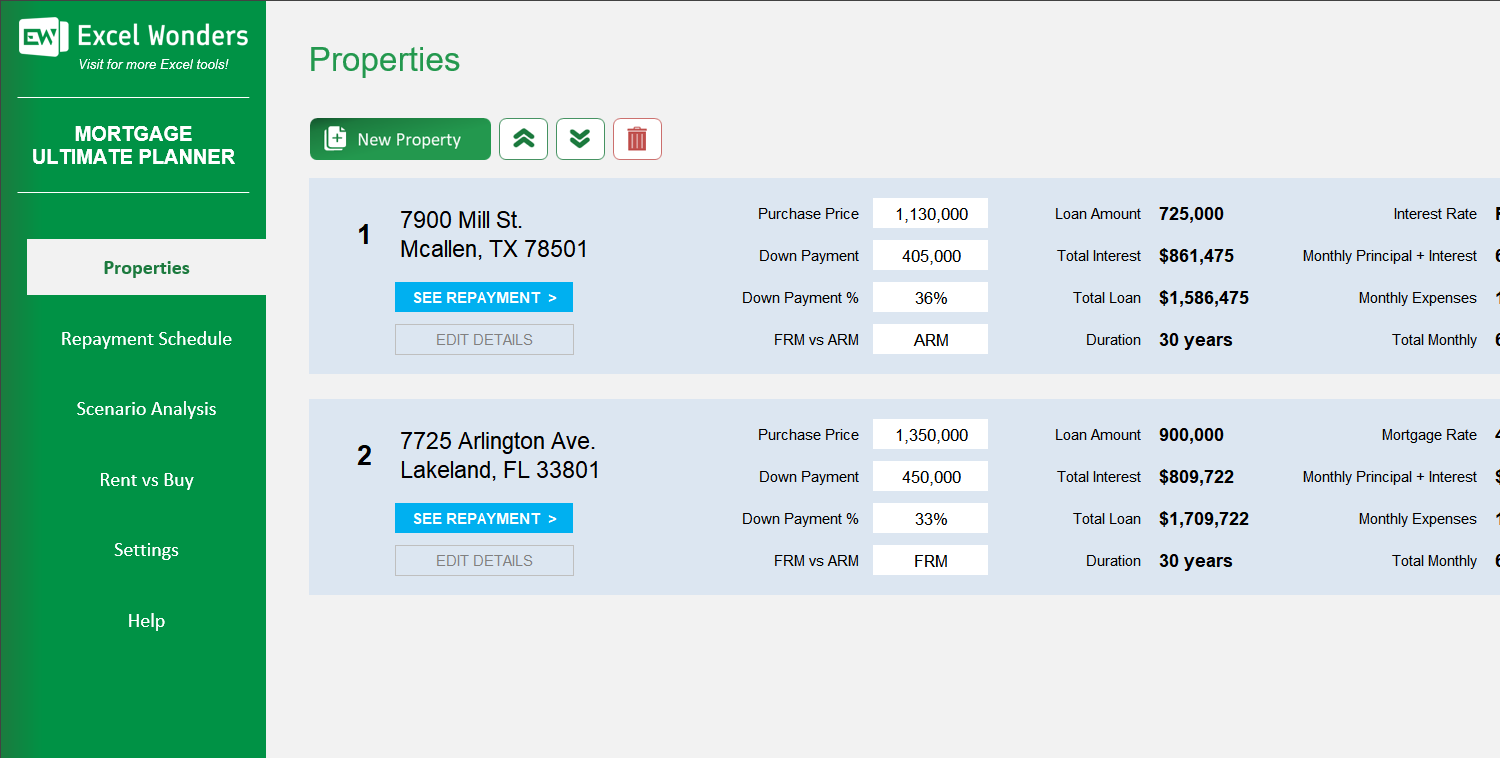

Easily compare multiple properties, analyze mortgage repayment schedules, and test scenarios—all within one intuitive spreadsheet. See monthly payments, total interest, and long-term costs in seconds.

Developed by experienced financial modelers, this template follows proven workflows used by mortgage professionals, ensuring accuracy and actionable results every time you use it.

Trusted by homebuyers and investors worldwide, the Mortgage Ultimate Planner Excel Template is your reliable partner for smarter property decisions, backed by transparent calculations and easy-to-understand reports.

Features:

1 review

1 review

Very helpful, loved this template

Review for: Mortgage Ultimate Planner Excel Template

Yes. On the 'Repayment Schedule' sheet, click the 'Export' button in the top-right corner. A dialog box will appear where you can set the file name, format, and save location for your exported schedule.

These inputs are used in the 'Rent vs. Buy' and 'Scenario Analysis' calculations: • Inflation Rate: Helps project the future growth of expenses like property tax. • Tax Rate: Used to calculate the potential tax benefits from mortgage interest deductions. • Annual Rate of Return: Estimates potential investment returns on funds used for a down payment.

This template is an all-in-one tool designed to help you make informed decisions when buying a house. Its key features allow you to: • Compare multiple prospective properties. • Simulate mortgage repayment schedules. • Analyze different financial scenarios. • Evaluate whether it is better to rent or buy.

To make the best use of the planner, follow these steps: 1. Configure Settings: Go to the 'Settings' sheet to input your mortgage start date, interest rate information, and other key financial assumptions. 2. Add Properties: On the 'Properties' sheet, add up to 10 prospective properties you are considering. 3. View Repayment Schedule: Use the 'Repayment Schedule' sheet to view and compare payment plans. 4. Analyze Scenarios: Use the 'Scenario Analysis' and 'Rent vs. Buy' sheets to evaluate different outcomes.

All properties are managed on the 'Properties' sheet: • To add: Click 'New Property' and complete the form in the pop-up window. • To edit, reorder, or delete: Use the control buttons provided on the sheet to manage the properties in your list.

These are two common types of mortgages: • FRM (Fixed-Rate Mortgage): Has an interest rate that remains the same for the entire term of the loan. • ARM (Adjustable-Rate Mortgage): Has an interest rate that is fixed for an initial period and then changes periodically based on market indexes.